The Economic Impact of the COVID-19 Pandemic on Southeast Asia

By Dominique Fraser

Published on 5th December 2022

Read in 7 minutes

After two-and-a-half gruelling years, Southeast Asia has opened its economies and borders and is learning to live with COVID-19. The Asia Society Policy Institute and Asia Society Australia are therefore bringing our long-running Southeast Asia and COVID-19 project to a close. As we do so, we briefly revisit earlier project analysis of the pandemic’s effect on the region’s geo-politics, economics, and society.

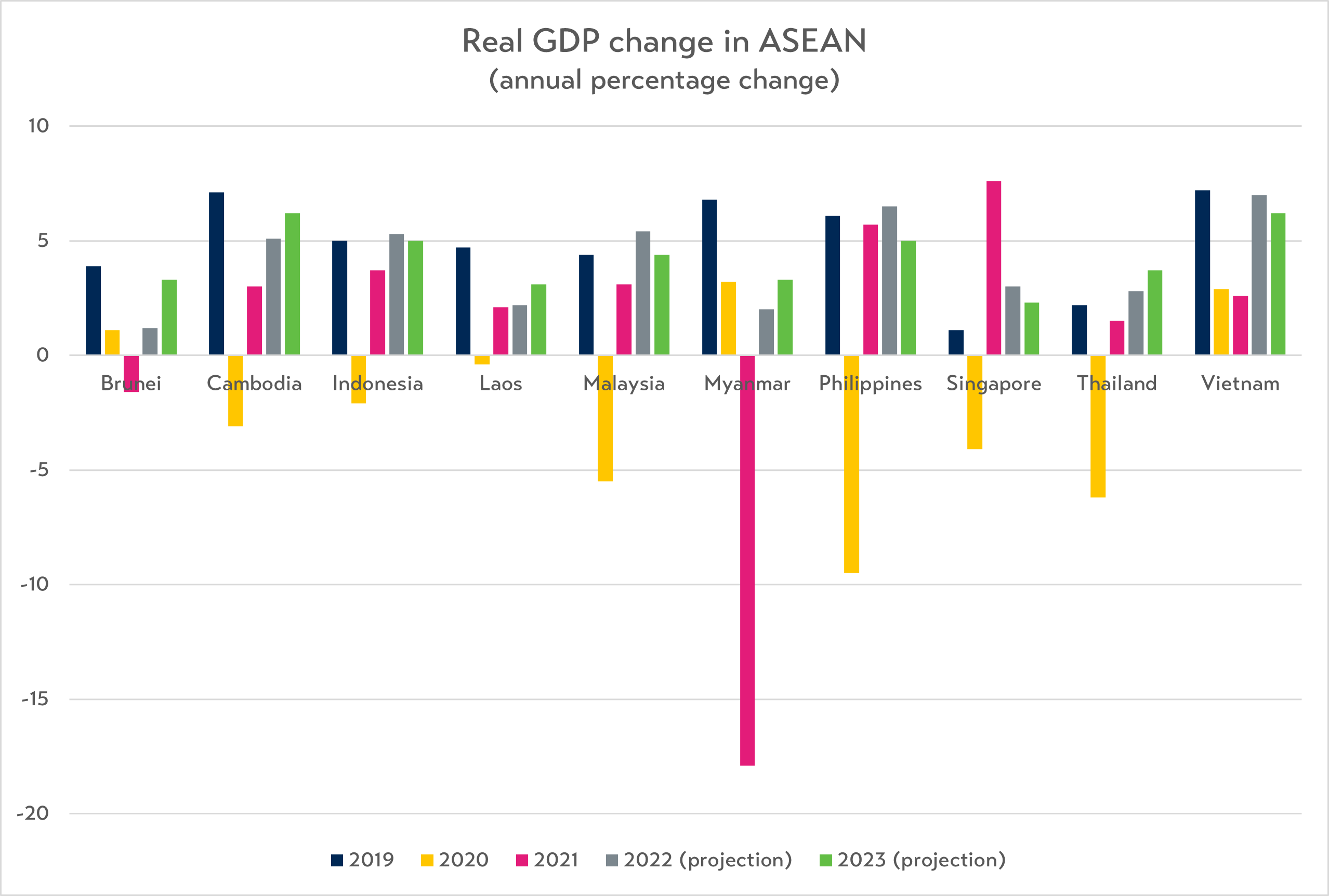

Just as COVID-19 swept across Southeast Asia in three primary waves, so too has the macroeconomic impact of the pandemic and the region’s subsequent recovery unfolded in three phases. The first phase began in early 2020, when most economies plunged into recession as borders and economies shut, tourism died, supply chains struggled, and global demand tanked (see Table 1).

The second phase began at the start of 2021 when a tentative recovery was threatened by a devastating Delta wave, as Richard Maude wrote at the time for this project. Regional recovery strengthened throughout 2022, despite yet another COVID wave, this time driven by the Omicron variant.

The region has now entered a third phase, one in which governments are having to navigate a sharply deteriorating global economic outlook marked by inflation, energy and food price shocks from the war in Ukraine, and lower growth in China. These factors will dampen, but likely not arrest, economic growth in the region.

Table 1

Source: IMF DataMapper

Troubled services, strong commodities

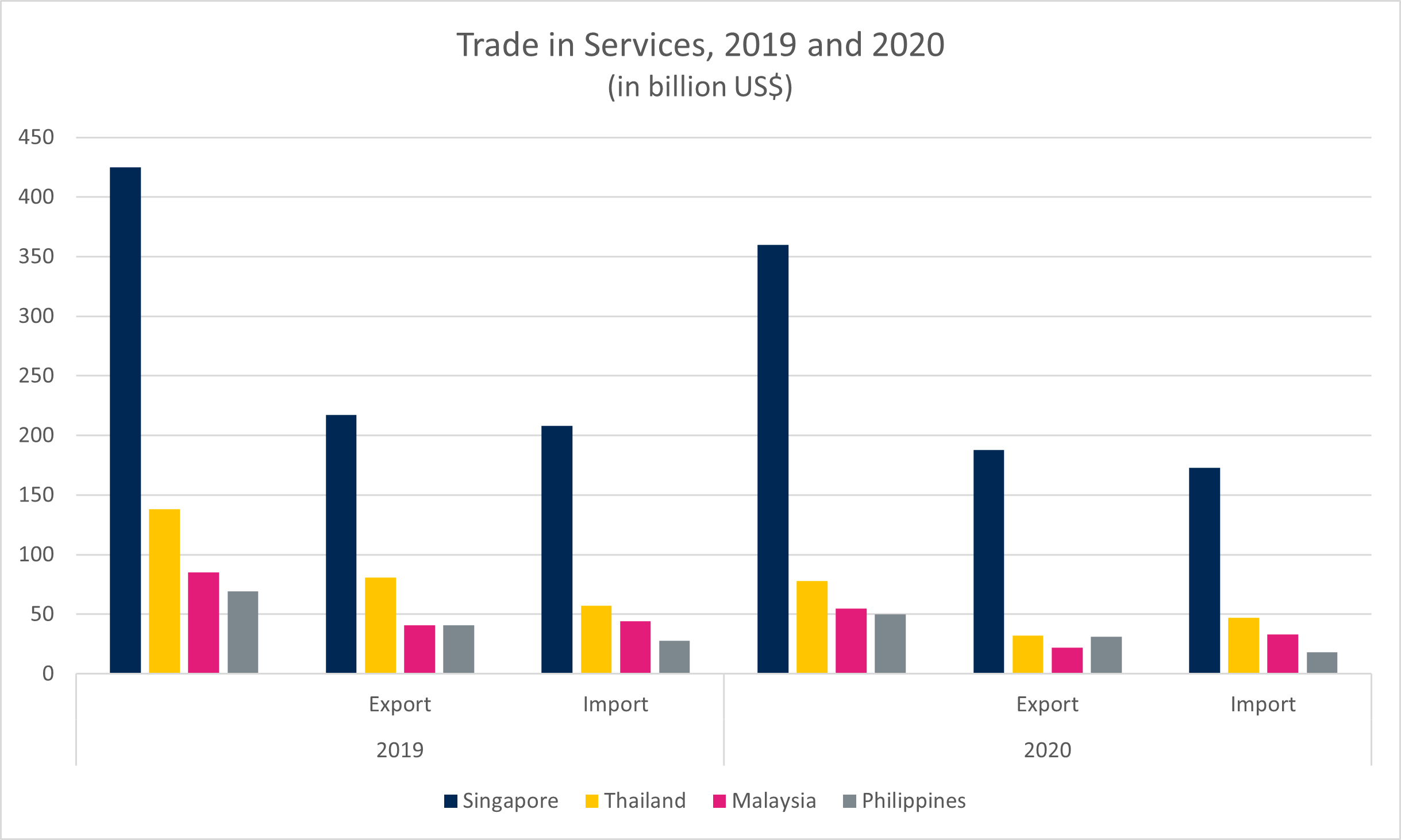

As the first COVID wave spread across the region from January 2020, the Philippines, Thailand, Malaysia, and Singapore saw particularly large GDP losses. This can in part be explained by their growth being primarily driven by their services sectors, in particular travel and tourism, transport, and business travel. These took an early heavy hit as visitor arrivals to the region plummeted by over 80 percent and the travel and trade hub Singapore nearly came to a standstill (see Table 2).

Conversely, digital services exports, which make up a significant part of the economy in the Philippines, and are growing in Cambodia and Laos, hardly dropped at all during the pandemic.

Table 2

Source: ASEANStats

In countries where agriculture still plays a large role in the economy, which is the case in Myanmar, Laos, and Cambodia, the hit to GDP was less pronounced. Myanmar’s marked GDP drop in 2021, meanwhile, was predominantly due to the 1 February 2021 coup, rather than an effect of the pandemic.

Diversified economies, such as those in Singapore, Indonesia, and Vietnam, proved to be more pandemic resistant thanks to increased global demand for key exports and heightened prices of some commodities.

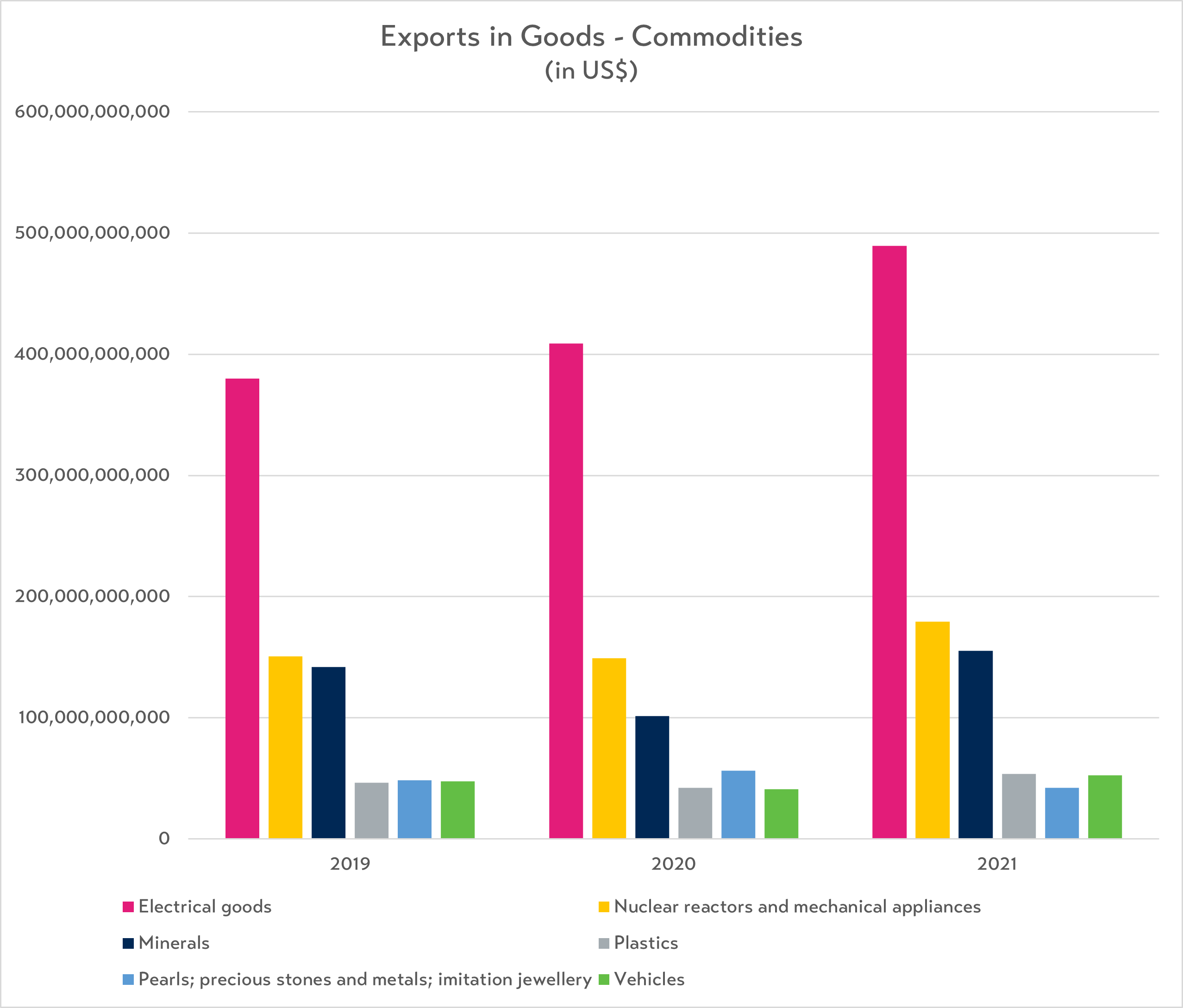

Globally, trade in several products (e.g., fuel, vehicles, steel) nosedived, while others (e.g., pharmaceutical products, food, and electronic goods) increased. Singapore and Thailand’s goods exports grew on the back of pharmaceuticals (by April 2020, Singapore’s exports saw a 170 percent increase) and food (Thailand’s rice exports grew by nearly a quarter in early 2020).

Demand for oil and gas, on the other hand, ground to a halt due a reduction in travel and the oil price reached its lowest levels in two decades. Indonesia, where petroleum and natural gas make up the largest export products (in dollar value), saw the loss of a quarter of its export value in these commodities. Price increases for copper and palm oil compensated some of this loss.

As working, entertaining, and shopping from home became the norm from mid-2020, demand for computers and TV sets surged, particularly across the United States and Europe. This was good news for electronics producers in the region, where electronic goods and components are the largest export product (in dollar value). ASEAN-wide export values increased nearly 30 percent from 2019 to 2021 (see Table 3), a trend that continued in 2022.

Table 3

Source: ASEANStats

As the world’s fourth largest exporter of electronic goods in 2021, Vietnam thus bucked the region’s trend and saw GDP growth across both pandemic years (see Table 1). The country was however hit hard by the 2021 Delta wave, which shut down factories leading to global supply chain disruptions as it did in many parts of the region, and Vietnam saw some of the lowest growth figures that year. Vietnam’s outlook for 2022 and beyond is again among the best in the region (see Table 1).

While goods trade held up well during the pandemic, several countries implemented export restrictions in the early months of 2020, mainly on personal protective equipment (PPE) and food. Malaysia, which accounts for 14 percent of global PPE exports, restricted the export of face masks on 20 March; Indonesia banned the export of antiseptics, PPE, and raw materials for surgical masks on 17 March; Thailand banned the export of face masks on 5 February; and Vietnam banned the export of rice on 25 March. Most of these restrictions only lasted a few weeks. Yet, they likely impacted trust with trading partners and ran counter to ASEAN’s own commitment to keeping trade open.

The human impact in Indonesia

A macroeconomic perspective is, of course, a very blunt measure of the pandemic’s many and varied impacts on Southeast Asian economies and societies. GDP data hides the economic scarring and human toll. A closer look at Indonesia shows a more complex story than the simple narrative of recession and recovery.

UNCTAD, for example, estimates that the expected output gap (or “lost” GDP – actual levels compared to forecasts) in Indonesia will be -9.2 percent in 2023, the second highest in the G20, behind only Russia.

More than 60 percent of Indonesia’s GDP is derived from micro, small, and medium enterprises (MSMEs). The vast majority of these companies, which account for 97 percent of all businesses in Indonesia, did not have any cash set aside or had just enough to weather one month of pandemic impact. Promised governmental assistance was slow to arrive.

In turn, many businesses had to lay off or furlough staff, with nearly a quarter of Indonesian breadwinners forced to stop working by June 2020. Half had to make do on a reduced income. In 2021, the World Bank lowered Indonesia’s income status based on 2020 figures, moving it from the upper-middle-income to the lower-middle-income bracket due to “COVID-19 related decreases”.

Higher unemployment figures remained stubborn throughout the pandemic, having shot up from 3.6 percent in 2019 to 4.4 percent in 2021. Those most effected were often young people, those who had migrated from rural to urban areas, and those employed in the service sectors.

Owing to these challenges, poverty rates in 2021 also increased, moving from the record-low of 9.2 percent in 2019 to 10.2 percent in 2021. Nearly half of all households with children struggled to find enough nutritious food during the pandemic years.

According to the Asian Development Bank’s (ADB) optimistic forecast, long-term substantial scarring is unlikely due to quick economic recovery, increased labour productivity, and reforms that will raise investment and productivity. Yet, uncertain global circumstances are putting this assessment at risk (see below).

And some effects will be long-lived. For example, nationwide school closures that lasted more than 18 months will lead to compounded productivity losses estimated to be just under 2 percent after 45 years. These macroeconomic considerations play out along socio-economic lines on the individual level, with a disproportionate impact on children from disadvantaged backgrounds, who will experience larger wage losses due to the pandemic than their more privileged peers.

What happened in Indonesia was replicated across much of Southeast Asia. According to ADB research, the largest output gaps occurred in the Philippines, Cambodia, Malaysia, Laos, and Thailand.

Recovery

In late 2022, the world’s economic outlook is increasingly “gloomy and uncertain”, as the IMF stated so pessimistically. High inflation and low growth have some fearing that we are entering a prolonged period of stagflation as many countries across the world are tightening fiscal and monetary policies – albeit unevenly.

While inflation in the region is mostly at lower levels than elsewhere, including the United States and much of Europe, price increases, particularly in Myanmar and Laos as well as Thailand, are putting added pressure on the millions of people who live in extreme poverty, many of whom fell below the poverty line during to the pandemic.

This is the difficult global economic situation in which Southeast Asia tries to navigate its recovery. At the same time, debt-to-GDP in Southeast Asia grew from 49 percent in 2019 to 63 percent in 2021 (and as high as 94 percent in Laos), partly due to countries across the region allocating an average of 7.7 percent of their GDP to fiscal stimulus just as the economy contracted.

In addition to the direct effects of the pandemic, economies are facing ageing populations – even if at lower levels compared to elsewhere in Asia – and a slowdown of the forces of globalisation, which have fuelled much of the region’s growth over the past decades. Long-term post-pandemic recovery that lifts the region past the “middle-income trap” requires the region to implement institutional reform led by ambitious governments.

Since the start of 2022, economic recovery in the region has been led by several sectors: agriculture, which has benefited from workers who lost their jobs in tourism; construction, which has started to work on a huge backlog of infrastructure projects; and manufacturing, which is responding to strong external demand.

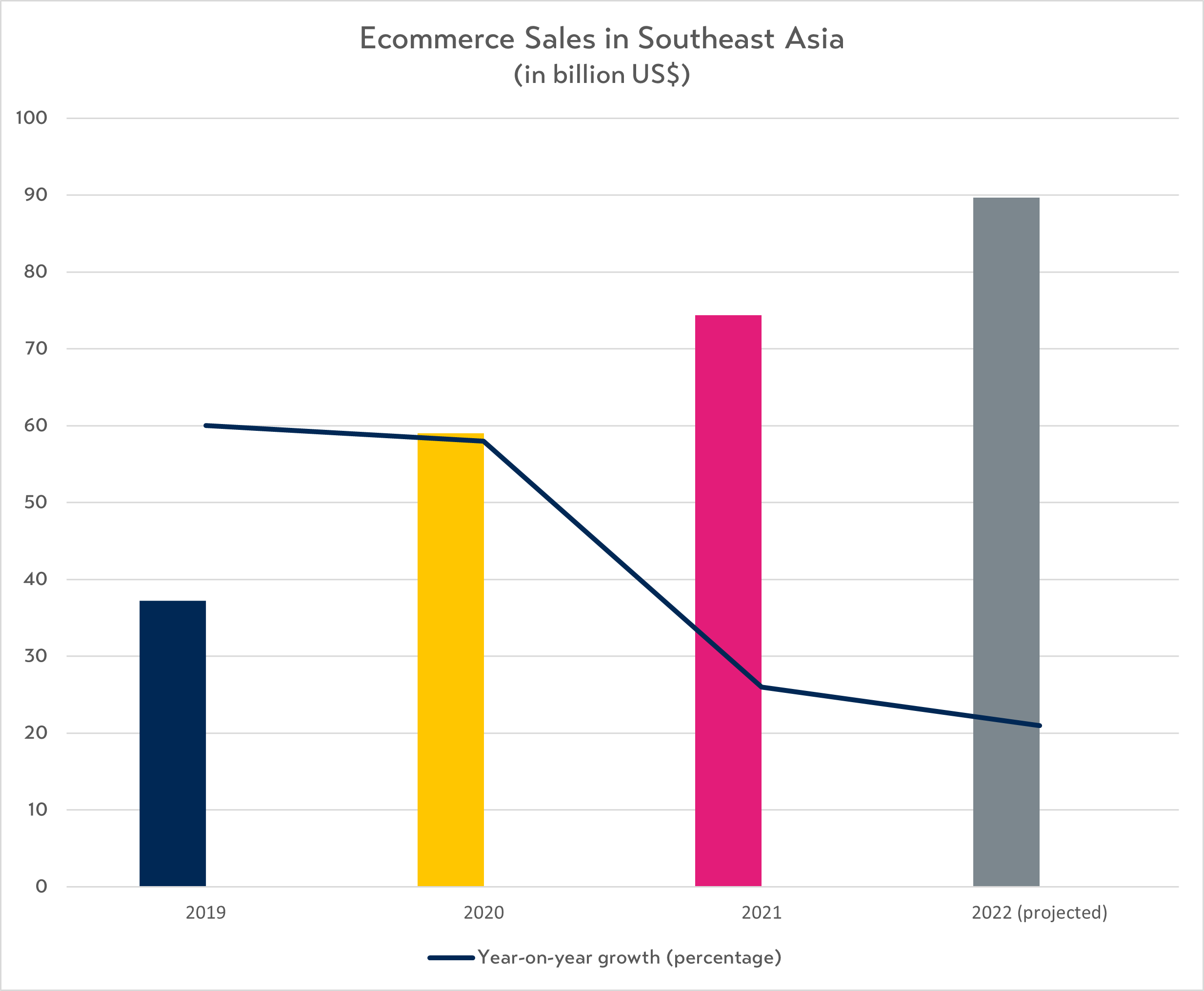

The boom in the digital sector continues to be another driver of post-pandemic recovery. Southeast Asia has emerged as one of the world’s biggest e-commerce growth opportunities, with over 70 million new online shoppers since the beginning of the pandemic. Growth is particularly strong in the Philippines, Indonesia, and Vietnam. Interestingly, while e-commerce sales have steadily increased since 2018, the pandemic doesn’t appear to have a big impact on its growth, with the proportion of year-on-year growth decreasing since 2019.

Table 4

Source: eMarketer

There are also positive signs when it comes to the services trade, especially the region’s important tourism sector. While the return of tourism to pre-pandemic levels across much of Asia is slow compared to the rest of the world, there are signs it is starting to take off as Southeast Asia is leading recovery in the wider region. From June to August 2022, flight bookings to the Philippines, which was the first in Southeast Asia to re-open borders to fully vaccinated tourists, were at 70 percent compared to 2019 levels. Much of this is driven by those returning to visit friends and family after long years of pandemic-induced separation, sparking hope for a brighter future despite economic uncertainties.

Skip to section:

Impacts on the Economy and Ways to RecoverSkip to section:

Impacts on the Economy and Ways to Recover