COVID-19 and Southeast Asia’s Long Road to Economic Recovery

By Richard Maude

Published on 10th November 2020

Read in 12 minutes

Food Delivery Drivers – #herCOVIDstory © UN Women / Ploy Phutpheng

Introduction

The fight against the COVID-19 pandemic has come at enormous economic cost in Southeast Asia. Some economies will bounce back faster than others, but the road to recovery will be long and difficult in much of the region.

Nor is Southeast Asia’s fate entirely in its own hands. The pace and depth of the region’s economic recovery will depend on the global path of the pandemic, the success or otherwise of vaccine development and the rebound of demand for the goods and services Southeast Asia produces.

For all this challenge, Southeast Asian countries are planning energetically for recovery and looking for opportunity in adversity.

Support from the region’s partners for these efforts is vital. International aid has been re-geared to respond to COVID-19 priorities. But needs are high. There is scope for more support for public health services, vaccines, technical advice on recovery plans and social assistance programs, debt management and fiscal stability, investment in infrastructure geared to a green recovery, and lifting human capital.

There are strong humanitarian and national interest reasons to drive international assistance. External support for Southeast Asia at this time of crisis helps support social stability and alleviate the pandemic’s crushing effect on the region’s poor.

How well Southeast Asia recovers will also have a significant bearing on the region’s longer-term strength, resilience and independence. Southeast Asia sits at the cross-roads of Asia’s changing strategic landscape. A weaker, more distracted and internally focussed Southeast Asia will be more vulnerable to China’s growing power and less able to manage the pressures of sharper US-China competition.

Skip to section:

A tsunami of economic damage Is the worst over? The road back Interviews About the AuthorA tsunami of economic damage

The Asian Development Bank (ADB) forecasts a 3.8 per cent contraction in Southeast Asia’s economy in 2020.

Most of this damage occurred in the first half of the year. The very interconnectedness that has fuelled Southeast Asia growth in past decades suddenly became an acute vulnerability. China’s lockdown restricted the flow of vital manufacturing inputs. Factories slowed or stopped production. Retailers cancelled orders as consumers stopped spending in the United States and major European markets. The closure of international borders and domestic lockdowns brutally shut down Southeast Asia’s booming tourism industry.

Across the region, businesses shut their doors, foreign capital fled, and stock markets and exchange rates plummeted. Foreign direct investment sagged. Millions found themselves with no or insufficient work.

Source: International Monetary Fund

Malaysia was hit hardest – its economy contracted by a whopping 17.1 per cent in the second quarter. The Philippines was not far behind, down 16.5 per cent. Singapore’s economy fell 13.3 per cent and GDP growth was down 12.2 per cent in Thailand. Indonesia’s economy suffered its first contraction in more than two decades, down 5.3 per cent.

These economic blows have been particularly severe on the poor, although even Southeast Asia’s middle class is feeling the fragility of its recent modest prosperity. The World Bank forecasts that between 5 and 9 million additional people will fall into extreme poverty across East Asia and Pacific as a result of the pandemic. The forecast rises to between 18 and 32 million people when measured against the $3.20 poverty rate applied to lower middle-income countries.

Women dominate employment in many hard-hit or vulnerable sectors, such as clothing and other manufacturing, tourism, food services, retail and the large informal sector. The United Nations reports that women and girls are experiencing significant unemployment and loss of income, difficulty in accessing health care and hygiene products, increased unpaid domestic work and higher levels of gender-based violence.

Source: International Monetary Fund

Is the worst over?

Both the ADB and the International Monetary Fund (IMF) are forecasting a return to economic growth for Southeast Asia in 2021 – to 5.5 per cent in the case of the ADB and 6.1 per cent for the IMF. Recent factory output and order volume indicators for ASEAN confirm an improvement in conditions from the deep second quarter slump.

The region is being helped by China’s re-opening – Southeast Asia looks to China to drive economic recovery – and the successful containment of the pandemic in some parts of the region.

Government fiscal packages targeting individuals, households and businesses provided some much-needed support. The tool kit for Southeast Asian governments includes tax cuts or holidays, direct cash transfers, wage subsidies and loan guarantees. Spending on frontline medical services has also increased.

As of September, these support packages amounted to a relatively modest 12.4 per cent of combined regional GDP. Given the scale of the crisis this is arguably too little, although some countries have spent much more. Singapore’s stimulus spending, for example, now totals 20 per cent of GDP. The impact of support programs has also been weakened in some Southeast Asian countries as governments struggled to get help out the door quickly.

Southeast Asian governments worked to prop up financial markets and boost liquidity. Exchange rates have stabilised, plummeting regional stock markets have clawed back some of their losses and capital outflows have slowed or reversed. Remittances, important to some Southeast Asian countries who export labour, like the Philippines, are showing some signs of recovery.

Even so, Southeast Asia’s economic recovery is likely to be U-shaped at best, troubled by uncertainty and prone to setbacks. The Asian Development Bank says the journey ahead will be “slow and painful”.

Aggregate growth figures for Southeast Asia also hide significant regional variation. Vietnam is likely to end 2020 with a small increase in GDP. At the other end of the scale, the IMF forecasts large contractions of 7.1 per cent and 8.3 per cent respectively for Thailand and the Philippines. Indonesia’s economy is expected to decline by 1.5 per cent.

Source: Johns Hopkins University

Several factors will influence recovery across the region. First, the pandemic must be contained. This has been achieved in much of the region but not, notably, in Indonesia and the Philippines. Regional countries must then find effective strategies to limit further outbreaks while they gradually open and normalise their economies. Further lockdowns will be devastating for regional businesses and politically and economically difficult to maintain, as the short-lived second shutdown of factories in Myanmar’s Yangon province recently demonstrated.

Second, as many Southeast Asian economies are highly dependent on external demand, their ability to bounce back will be significantly influenced by the outlook for their major trading partners. The recovery of the tourism sector in particular is tied to the global path of the pandemic. And the shifting global trade and manufacturing landscape offers a mix of peril and opportunity for the region (as a forthcoming essay in this series will explore).

Third, the ability of regional governments to continue to provide significant fiscal stimulus to their economies will be important, including through ongoing social assistance packages, support for businesses and investment in infrastructure and other projects that generate growth and employment.

Finally, domestic political crises now unfolding in Thailand and Malaysia could hamper economic planning and raise risk for foreign investors.

The road back

Increasingly, Southeast Asian governments are seeking to look beyond the daily demands of managing still unfolding health and economic crises to longer-term economic recovery. Circumstances and ambition vary across the region, but governments are trying to find opportunity in the crisis.

Singapore’s Emerging Stronger Taskforce, for example, will report to the government next year on strategies to “refresh, re-imagine or reset” the city-state’s economic strategies. Malaysia’s short-term economic recovery plan includes measures to boost the digital economy and encourage foreign investment in manufacturing. A medium-to-longer term “resilience” plan is being developed.

Myanmar’s economic recovery plan also seeks to encourage investment and reduce the cost of doing business. Vietnam has announced a new industrial policy to move the country up the manufacturing value chain and improve competitiveness. And in Indonesia, President Joko Widodo wants the pandemic to spur a big “leap” forward for the Indonesian economy and reinvigorate his de-regulation and competitiveness agenda.

Work goes on in Jakarta – ILO/ F. Latief – Flickr

Still, the political economy of most Southeast Asian countries is complex. Reform is a slow process, often derailed by vested interests, bureaucratic weaknesses and economic nationalism. It remains unclear how much will there is for deep, difficult reforms to improve productivity and competitiveness and reduce inequality. In Indonesia, for example, President Jokowi’s attempts to deregulate and promote investment have become mired in controversy.

The stakes are high – lasting economic damage, higher poverty, higher debt and deficits and more inequality. In such extraordinary circumstances, higher than usual levels of support from Southeast Asia’s partners is essential.

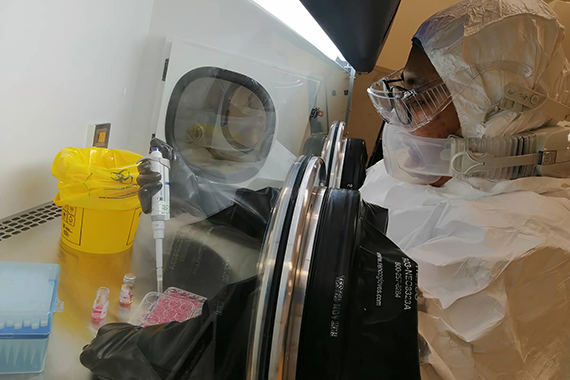

First, supporting Southeast Asia’s public health systems must remain a priority. The goal is what the World Bank calls “smart containment” – keeping the pandemic at bay to allow most of the economy to operate normally most of the time. If this can be achieved, the keys are likely to lie in robust real-time monitoring, sophisticated testing and tracing capabilities, localised lock-downs and ongoing social distancing discipline.

Some Southeast Asian countries will need sustained international help to develop and deploy these capabilities. Without them, the region could remain a patchwork of pandemic success and failure. Some parts of the region could find themselves stuck in the worst of all worlds, able neither to fully contain the pandemic nor to fully open their economies.

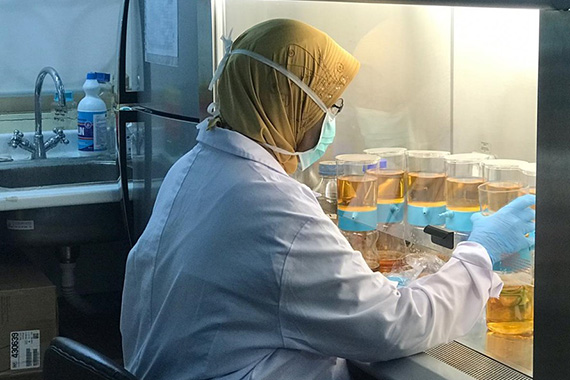

Vaccines must be a complement to these strategies, not a substitute. The challenges of cold storage, distribution and possible domestic manufacture of vaccines are formidable. Health workers and high-risk groups like the elderly must take priority.

Indonesia and some other Southeast Asian countries are moving to lock in vaccine supplies from China, which has taken up “vaccine diplomacy” across the region with gusto (while the United States is missing in action). Myanmar is looking to Russia. Thailand is trying to develop its own vaccine.

There are alternatives. Donor contributions to support the COVAX Advance Market Commitment (COVAX AMC) facility will help secure vaccines for developing countries. Southeast Asia’s partners could also follow the lead of Australia, which has made access to safe and effective vaccines a major plank of its response to the pandemic in the Pacific and Southeast Asia.

Australia and Indonesia partner to work on a COVID vaccine – Australian Embassy Jakarta – Flickr

Second, donors can step up their support for technical advice on the complex policy decisions facing Southeast Asian governments in areas like social assistance programs, fiscal stimulus and infrastructure investment.

Emergency fiscal support packages in Southeast Asia can’t be maintained indefinitely without raising debt and financial stability concerns. The high-wire act here is to carefully and gradually unwind some emergency measures in favour of investment in broad-based social security assistance for the most vulnerable. Where these don’t exist, such programs could include universal health care, social insurance schemes and more comprehensive social support programs for the poor.

The ability of some Southeast Asian governments to sustain significant fiscal stimulus is also constrained by narrow tax regimes and wasteful subsidies, for example on fuel. These are politically difficult reforms, but there might be opportunity in the current crisis for partner countries to re-prosecute them. Revenue mobilisation in countries in East Asia and the Pacific (excluding China) is estimated at 18 per cent of GDP on average, compared to 25 per cent in other developing economies and 36 per cent in advanced economies.

Third, partner countries can help Southeast Asia manage rising debt levels and financial stability. Debt relief for eligible Southeast Asian countries, in line with the G20’s commitment to suspend debt service payments for the world’s poorest countries, is an important priority. In July, for example, the European Union and six of its member governments announced a moratorium on debt repayments due to Myanmar amounting to some US$100m.

While markets have stabilised, economic uncertainty and higher government and company debt burdens pose ongoing risks. Some Southeast Asian countries could face financial instability if capital outflows resume and currencies once again begin to depreciate. International support for the region could be strengthened by more currency swap lines and stand-by facilities. These would support dollar liquidity and financial stability when needed, as recommended recently by leading regional economists.

Multilateral assistance in the region is patchy. The United Nations, World Bank, ADB and Asian Infrastructure Investment Bank have been the main multilateral contributors. But only Myanmar is receiving support from the International Monetary Fund (IMF). Resentment of the IMF’s role during the 1997 financial crisis lingers across the region and asking for help remains politically unpalatable.

The region’s much touted “Asian IMF”, the Chiang Mai Initiative Multilateralisation (CMIM), has also remained on the sidelines. This has prompted yet more tinkering by its member states, notably to make it easier to access assistance in the absence of an IMF program. But whether the CMIM can ever operate effectively as a regional financial safety net remains in doubt.

Fourth, partner countries could devote additional support to Southeast Asian efforts to tackle unemployment and re-build human capital. If sustained over time, high levels of unemployment will increase poverty and inequality and lower growth potential.

The global consulting firm McKinsey and Company argues Southeast Asian governments will need to make reskilling and re-deployment support available at an “unprecedented scale”, including through re-skilling partnerships with the corporate world, increased government funding and better use of data to identify what jobs will come back and to match people with work. One of Southeast Asia’s hardest hit economies, Thailand, for example, is offering subsidies for employers to hire graduates.

Many Southeast Asian businesses won’t reopen. More broadly, the pandemic is accelerating a shift towards automation and digitisation.

Some workers seeking jobs in the post-COVID economy are likely to require different and higher-order skills. Regional countries also need help re-gearing schooling and vocational education for a COVID-19 world.

Fifth, there will be significant opportunities to help regional governments invest for recovery.

Partner countries can re-double efforts to encourage public investment programs that will accelerate a transition away from fossil fuels and towards lower-carbon economies. Regional governments could develop more renewable energy infrastructure and offer incentives for consumers and companies to improve energy efficiency and invest in renewable power generation.

The International Monetary Fund has identified an “emerging cluster” of growth opportunities amid an otherwise bleak pandemic economic landscape. These include e-commerce, new data enabled services and biotechnology. Southeast Asia’s consumer class has embraced e-commerce enthusiastically. But, in much of the region, the absence of affordable, high-speed broadband creates a significant digital divide. Investing in ICT infrastructure as part of a longer-term recovery plan makes sense.

Elsewhere, regional governments can increase access to digital payment systems, put more government services on-line (as some are already doing), and make cross-border e-commerce easier. More bilateral or regional e-commerce arrangements, such as the leading-edge Australia-Singapore Digital Economy Agreement, could reduce barriers to digital trade and set high-quality rules on issues such as data transfer, protections for source code and e-payment frameworks.

Sixth, sharing COVID-19 border management best practice will help Southeast Asian economies more effectively manage cross-border trade and travel. Over time, participation by the region’s partners in “green lanes” for important business travel and broader “travel bubbles” for tourists will support a phased return of the people-to-people flows so vital to Southeast Asia’s economy. Common fast-testing procedures using proven methods will reduce the need for quarantine measures, a major inhibitor of travel. The region is already cautiously experimenting with these measures, but so far only with other Asian partners.

Seventh, the region’s partners can help by supporting cross-regional initiatives launched by the Association of Southeast Asian Nations (ASEAN). ASEAN is establishing a special regional response fund to help procure medical equipment and supplies, for example. Japan, China, South Korea and Australia have already contributed. A regional medical supplies reserve is also planned.

Lastly, ASEAN leaders have underlined the importance of the smooth flow of trade in essential goods such as food, medicines and medical equipment, as well as strengthening the resilience of regional and global supply chains. Some of the region’s partners have been quick to make similar commitments and to promote further regional economic integration, including through the Regional Comprehensive Economic Partnership trade deal which could be concluded this year.

Interviews

About the Author

Richard Maude is Executive Director of Policy at Asia Society Australia and a Senior Fellow at the Asia Society Policy Institute. Mr. Maude joined Asia Society after a 30-year career as an Australian diplomat and intelligence official. He is a former Deputy Secretary of the Department of Foreign Affairs and Trade, Director-General of the Office of National Assessments, and senior foreign policy adviser to Prime Minister Julia Gillard.